Know Your Investor (February Edition): F-Prime Capital Partners

Shots:

- Know Your Investor is an earnest effort from PharmaShots to acquaint our readers with leading Investors and venture capital firms in the healthcare industry

- Founded in 1969, F-Prime Capital Partners is a subsidiary of Fidelity Investments and primarily invests in healthcare and technology

- A total of 40 investments were closed by F-Prime in 2023, compared to 34 in 2022, in biopharma companies, devices, diagnostics, and manufacturing

F-Prime Capital Partner

Known for sweepingly and unstintingly investing in health and tech, F-Prime Capital Partners is an integral part of the renowned investment firm, Fidelity Investments. Fidelity Investments was established during the Great Depression by Edward C. Johnson II in Massachusetts, United States. In 1946, it was founded as a single mutual fund investing company, which has now grown into a $3.9 Trillion company. The business areas covered by Fidelity include a brokerage firm, mutual funds, fund distribution and investment advice, retirement services, index funds, wealth management, securities execution/clearance, asset custody, and life insurance.

With operations across North America and Europe, F-Prime was founded in 1969 and headquartered in Cambridge, Massachusetts. For its overseas investments, F-Prime collaborates with Eight Roads with its sister funds in London, Shanghai, Beijing, Hong Kong, Tokyo, and Mumbai.

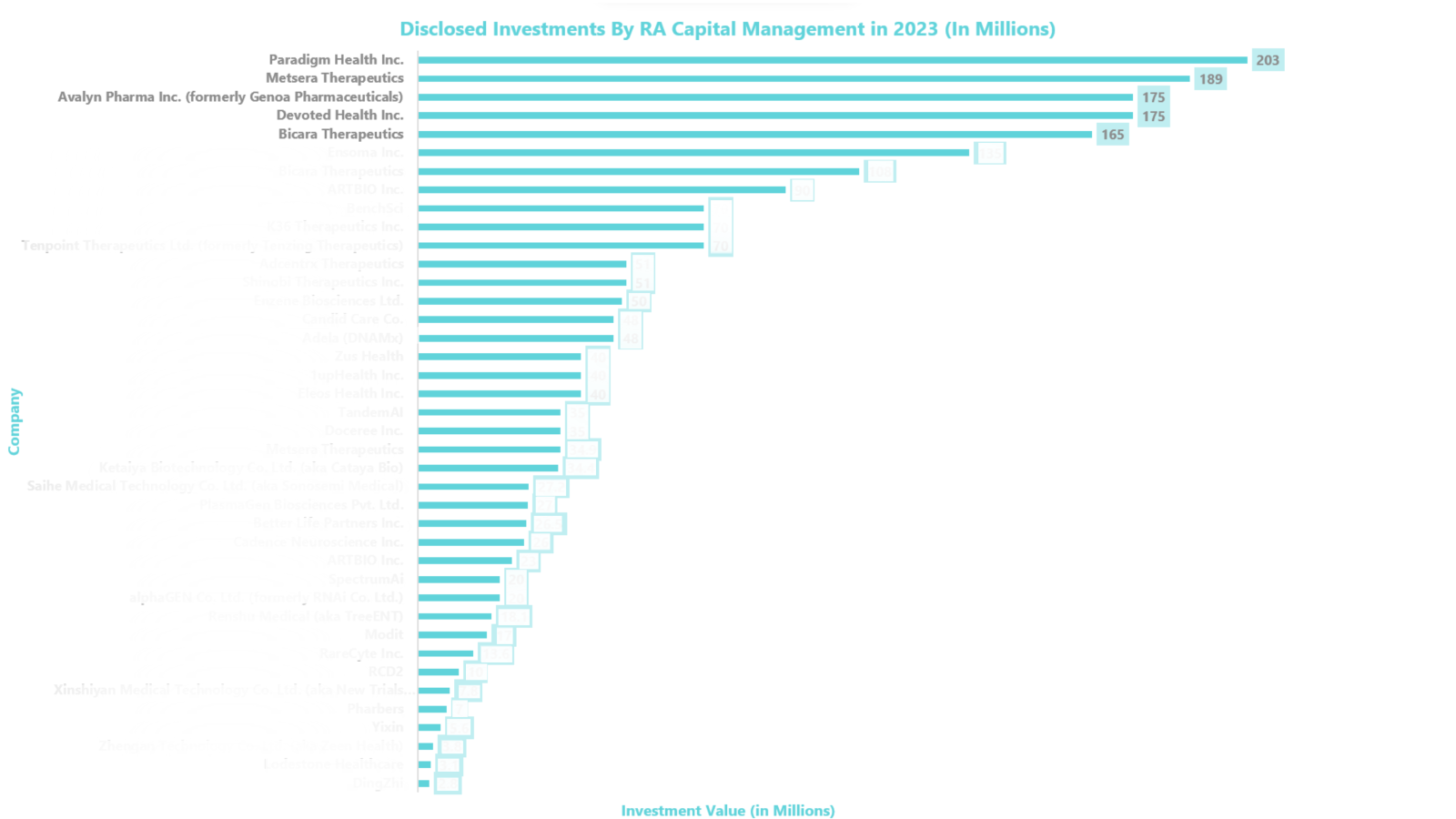

In 2023, F-Prime Capital participated in Seed, Series A, and Series B funding rounds. F-Prime includes a diverse range of companies under its portfolio, including Metsera Therapeutics, Adcentrx Therapeutics, TandemAI, Eleos Health, Lodestone Healthcare, etc. To date, F-Prime Capital Partners has made over ~200 investments in the Life Sciences and Healthcare sector. In 2023, Paradigm Health received the highest amount of funding worth $203M.

Around 40 investments were made by F-Prime Capital in 2023, with a significant number of deals in Manufacturing and Service providing companies followed by Biopharma companies. The focused therapy areas of 2023 were Cancer, Cardiovascular, Dental, Hematology, Inflammation, Musculoskeletal, etc. Furthermore, under the 40 investments made by F-Prime Capital, technologies that received considerable funding include Antibodies, Artificial Intelligence, Cell Therapy, Devices, Diagnostics, Digital Health, Gene Therapy, Immunotherapy, etc.

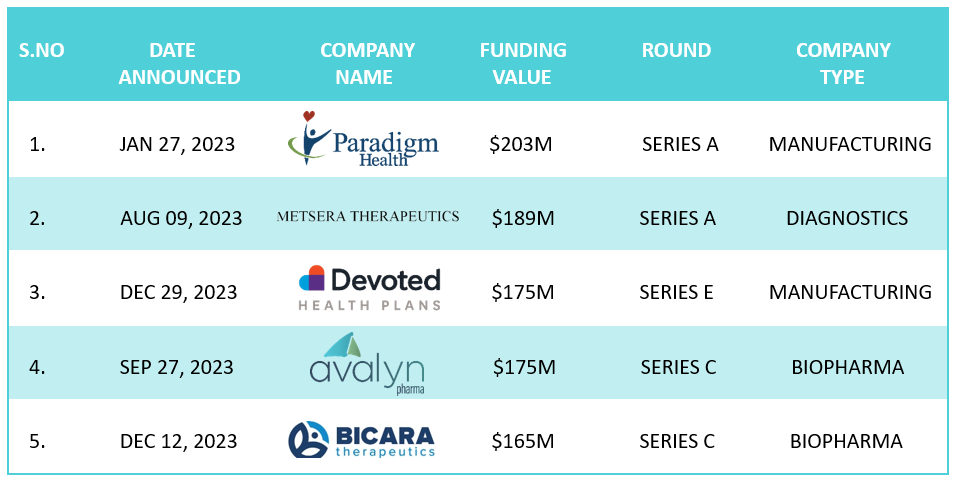

The top 3 investments made by F-Prime Capital in 2023, are as follows:

-

Series A funding worth $203M to Paradigm Health

-

Series A funding worth $189M to Metsera Therapeutics

-

Series E funding worth $175M to Devoted Health

In 2023, F-Prime participated in 5 funding rounds in the first quarter, 4 in the second, 6 in the third, and 4 in the fourth quarter. With $203M, Paradigm Health received the biggest investment from F-Prime.

F-Prime invested heavily in Oncology-driven companies, including Bicara Therapeutics ($165M, under Series C), Ensoma ($135M, under Series B), and Bicara Therapeutics ($108M, under series B)

The following table represents the top 5 funding rounds out of the 40 investments made by F-Prime Capital Partners in 2023

Note: For a complete report, reach out to us at connect@pharmashots.com with the subject line "F-Prime Capital Partners Data"

Related Posts: Know Your Investor (January Edition): RA Capital Management LLC

Tags

Shivani was a content writer at PharmaShots. She has a keen interest in recent innovations in the life sciences industry. She was covering news related to Product approvals, clinical trial results, and updates. We can be contacted at connect@pharmashots.com.